How to read (and understand) your credit card statement

If you have a credit card (or more than one), your lender is required to send you a monthly statement either by mail or if you requested, electronically. Each statement represents a snapshot of how you’ve used your card during a billing period.

While specific details vary by lender, your statement is a useful tool to help you track spending, confirm payments, identify unauthorized charges, and understand how much interest you’re paying. For high-interest cards, interest payments can be substantial.

Below is a summary of each of the basic statement sections, as well as tips on what you should pay attention to.

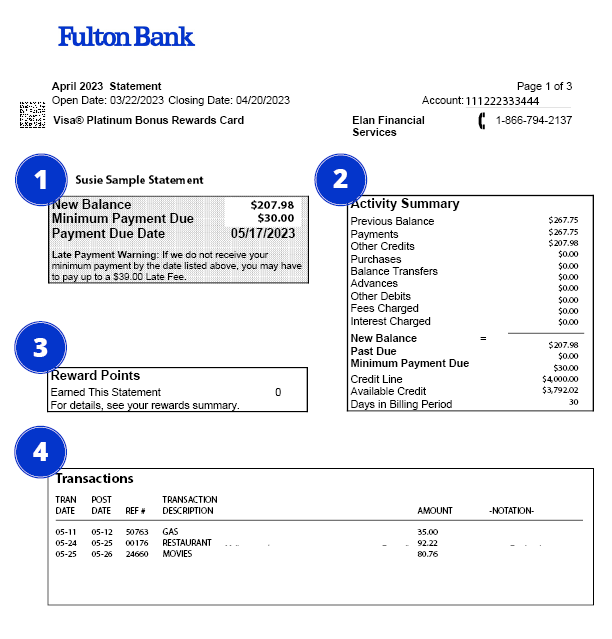

1. Payment information

• Payment due date: If you don't make at least the minimum payment by the due date, you'll incur a late fee, and your credit score may be affected.

• Your current balance: How much you owe on this statement.

• The minimum payment due: This shows you the minimum payment you must make to keep your payments current.

You will also find a minimum payment box that has a minimum payment warning. This box tells you how long it will take to pay off your current balance by only making the minimum payment. If you only make the minimum payment each period, you will pay more in interest and it will take you longer to pay off your balance. It also shows you how long it will take to pay your balance and potential savings by paying more than your minimum payment each month.

2. Account/Activity Summary

The account summary provides details on your account activity during the latest billing period.

• Previous Balance

• Payments

• Transactions

• Cash Advances

• Fees Charged

• Interest Charged

• New Balance

3. Rewards summary

This section will be on your statement if you have a rewards credit card, such as a cash-back or travel card.

• Rewards balance

• Previous balance

• Earned this period

• Redeemed this period

4. Transactions: Payments, Credits, and Adjustments

This section varies by lender, but it includes:

• Transactions: All the purchases you’ve made during this billing period. At a minimum, this will include the date, retailer and cost.

• Payments: Any payment or credit that have been applied to your account

• Fees: This could include balance transfer fees, late payment fees, or your card’s annual fee.

• Interest Charged:

o Interest charged on purchases, cash advances, or other balances

o Total interest for the period

o Year-to-date totals

o Interest charge calculation

o Annual Percentage Rate (APR) on your account by purchases and cash advances (if applicable)

When you know what to look for on your monthly statement, it’s easier to keep track of your finances. You’ll be able to see any purchases you’ve made, how much you owe and any rewards or credits you’ve earned. It can also help you flag potential fraud on your card if you know how to recognize unauthorized charges. If there are any mistakes, contact your credit card company right away.

Knowing how to read your credit card statement gives the tools you need to help you keep your credit on the right track.